Before you start selling your products or services, you must register your new business to be legally recognised. To make the process of registering your business a bit easier, we’ve created a checklist for you!

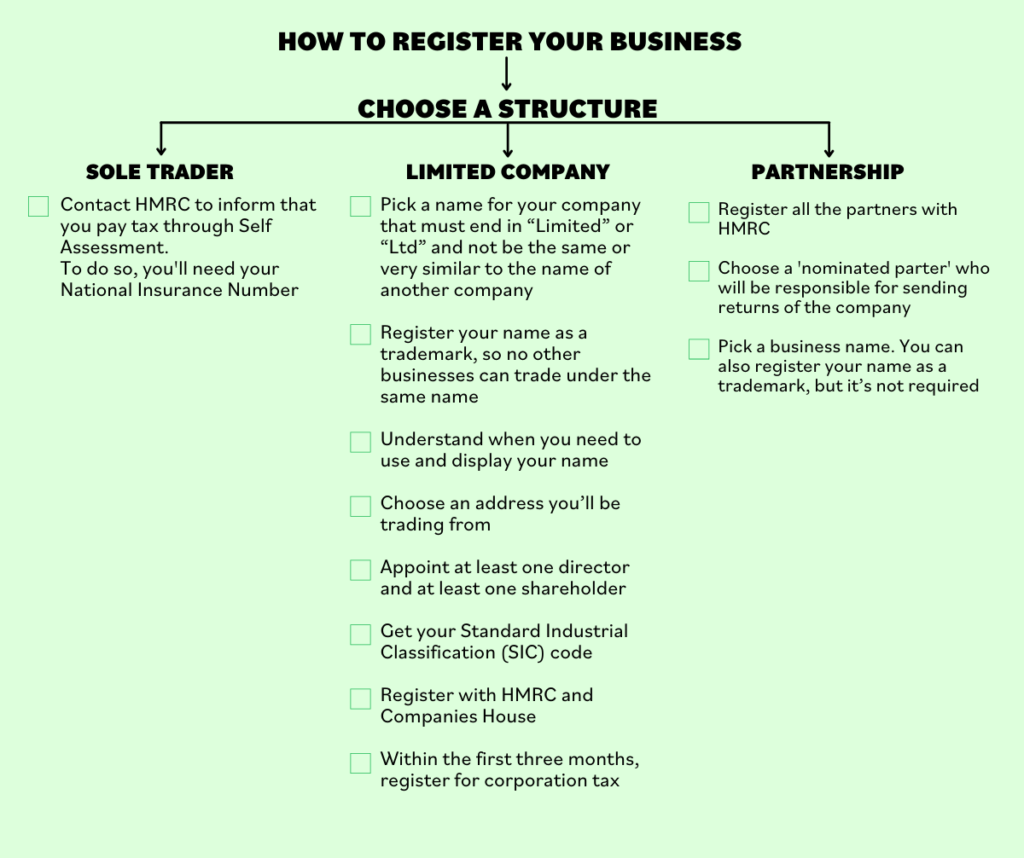

As the first step of registering your business, you need to choose a legal structure that fits your business. The options are registering as a sole trader, limited company or partnership. The process of registering depends on the type of your business.

Registering as a sole trader

If you’re a sole trader, you own and run a business on your own and you keep all the profit after paying tax and National Insurance. It’s a popular business structure for people such as photographers or hairdressers.

If you set up as a sole trader, it’s easier to operate your business as you have fewer regulations and filling duties. On the other hand, the owner of the business has unlimited liability to all debts and legal actions.

To register as a sole trader, all you need is a National Insurance Number and tell HMRC that you pay tax through Self Assessment.

Once you register, your responsibilities include:

- Keeping a record of all your business income and expenses

- Completing a Self Assessment tax return every year

- Paying Income Tax on your profits and Class 2 and Class 4 National Insurance. To work out how much you need to pay, you can use HMRC’s calculator

- Paying business rates if applicable

- If your turnover is over £85,000, you must register for VAT. If your turnover is lower, you can register voluntarily to reclaim VAT

Registering a limited company

A limited company can be set up by a single person who will be both a shareholder and director or by multiple shareholders. Benefits of setting up a limited company include:

- Liabilities such as debts or legal action are limited to the company, which means that if the business fails, you’re protected from going personally bankrupt.

- Corporation tax on profits is lower than the ones sole traders have to pay

- If you ever decide to sell your business, it’s easier to do it

- If you want to employ staff, you can pay salaries via the Pay As You Earn scheme

To register a limited company you need to:

- Pick a name for your company that must end in “Limited” or “Ltd” and not be the same or very similar to the name of another company

- Register your name as a trademark, so no other businesses can trade under the same name

- Understand when you need to use and display your name

- Choose an address you’ll be trading from

- Appoint at least one director and at least one shareholder

- Get your Standard Industrial Classification (SIC) code which describes the nature of your company

- Register with HMRC and Companies House

After registering your business, within the first three months, you also must register for corporation tax.

Every year a limited company must put together statutory accounts and send an annual return to Companies House and a Company Tax Return to HMRC. You also must comply with statutory rules and disclose information to the public.

Get the ulimate guide to start a business

Registering a partnership

A partnership means that there are two or more people owning and running a business together. You must register all the partners with HMRC. However, a partner doesn’t have to be a person – a limited company also counts as a partner.

In the partnership, partners share the business’s profits, and each partner pays tax on their share.

In the same way as sole traders, the partners have unlimited liability and are responsible personally for the partnership debt.

To register a partnership you need to register a “nominated partner” who will be responsible for sending returns of the company and pick a business name that isn’t offensive, doesn’t violate copyright or include words that require official permission. You can also register your name as a trademark, but it’s not required.

When it comes to VAT, the rules are the same as for sole traders. This means that if your turnover is over £85,000, you must register for VAT. And if your turnover is lower, you can register voluntarily to reclaim VAT.

Checklist