First of all, congratulations are in order.

Why? For looking into online bookkeeping and accounting software in the first place.

You wouldn’t believe how many people keep their receipts in a bag and try and sort them out at the end of the year.

So whether you’re submitting your self-assessment tax return, paying VAT, want to keep an eye on your sales, or use the software purely for their professional invoice layouts, online bookkeeping and accounting software is the way to go.

But with so many options, where do you start?

You start by reading this quick article where we’ll break down three of the most popular accounting software providers so you can decide which one is best for you.

Let’s go!

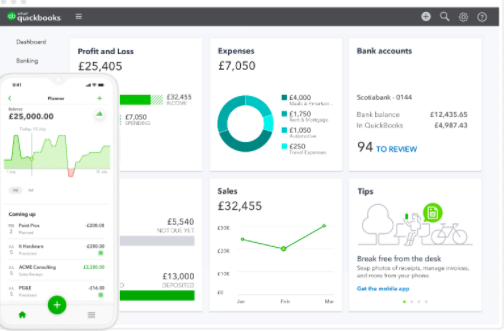

Quickbooks

When it comes to features, Quickbooks reigns supreme. You don’t need any of the expensive packages to get features like:

- Receipt scanning

- Mileage tracking

- Making Tax Digital VAT submissions

- Estimates & quotes

- FREE UK phone support

Quickbooks is the cheapest of the three accounting software in our list. If you simply want something to submit your VAT, send and track invoices, and log your receipts, it’ll cost you just £12 per month. If you’re not VAT registered and wish to use it for self-assessment purposes, it costs only £8 a month.

Note – for the most up-to-date pricing check the Quickbooks pricing page.

You can easily customise your Quickbooks dashboard to see reports for different departments and projects at a glance, which is fantastic for larger organisations.

Plus, Quickbooks will also most likely connect with your CRM or your eCommerce software.

Quickbooks is the software we encourage most of our clients to use, however, it may not be best suited for you and your business. Read on to find out more about accounting software.

Xero

Xero is fast becoming accountants’ go-to software for medium and large-sized businesses. Why? Because of its third-party add-ons. This is where Xero’s power comes in.

What that means in English is it can do some really cool stuff when linked up with any software you use for work.

For example, if you use an internet-based bank such as Starling, Xero will link up with your bank in real-time and show you your exact balance. Plus, Xero will pull through your bank transactions and automatically link them with receipts you’ve uploaded and invoices you’re waiting to be settled.

The potential integrations on the Xero Marketplace come in the thousands. This makes it an accountant’s playground, yes, but how much of it is relevant to you?

That depends on how complex your accounting needs are. If you ask “can Xero do that?” the answer will most likely be yes. But if all you use it for is to send invoices and track receipts, you may find it to be on the expensive side. If you want to send unlimited invoices, quotes and bills, you have to pay £24 a month. This doesn’t include mileage tracking or receipt capturing, which are add-ons.

As pricey as it is, it’s a powerful tool. Plus, although it’s not as user-friendly as Quickbooks or Free Agent, it’s still pretty easy to navigate.

Free Agent

Designed around user-friendliness, Free Agent’s interface is simple and easy to use.

As you’d expect, its simplicity also means it doesn’t handle more complicated business accounting as well as say Xero and Quickbooks, but this may not concern you if you’re looking for something simple to begin with.

Tracking cashflow is super-easy, and you can see which invoices are due, overdue, and paid at a glance.

The dashboard isn’t very customisable, but you might not need it to be.

If you’re a freelancer looking for something easy to use and simple, this may be your best bet. It’s not the cheapest, however, with prices starting at £19 a month plus VAT for sole traders.

On the off chance you bank with NatWest or RBS, you can use Free Agent for free!

What About Wave?

People may recommend Wave to you, but in a recent announcement, Wave informed its users they are not accepting any new signups from the UK.

Booooo.

While they’ve not said whether they’re cancelling existing UK accounts, the writing is on the wall.

This is a shame since Wave was the UK freelancer network’s go-to accounting software purely because of its user-friendliness.

Which Accounting Software Will You Choose?

There really is no one-size-fits-all when it comes to accounting software. Do a bit of digging around we’re sure you’ll find the best fit for you.

Whichever platform you choose, make sure you’re logging all of the allowable expenses you’re entitled to claim for.

Not sure where to start with that? Our FREE Pay Less Tax Guide is a great place to start.